Choosing a bank is one of the most important things to do upon moving to a new city or country. Having a bank account in a new city allows you to do countless things, from tasks such as depositing money from a first paycheck and paying for a gym membership to crucial processes such as renting or buying an apartment and paying utilities such as water, gas and electricity. In Spain, there are a variety of banks to choose from, each of which have different advantages and disadvantages to consider. Deciding which one is best can be complicated, especially when they all seem essentially reliable and trustworthy. Today in this article from ShMadrid we will be talking about the different elements to assess when choosing a bank in order to make the best decision.

Related article: Madrid’s Best Schools

Find the bank that suits you the best

The great variety of banks, while it may seem overwhelming when trying to decide on one, actually gives you a number of good options, and the Spanish capital represents a good number of them. In addition to traditional banks with physical offices and ATM’s at every corner, there is also the convenient and more accessible option of online banking which offers discounts and advantages from the moment you open an account with them. However, just as you would with a physical bank, it is important to assess the advantages and disadvantages of different online banking services in order to gauge their reliability. This is a crucial and basic characteristic you want in a bank, so that when you trust them with your money you know it is being taken care of. Another important detail to research before choosing a bank is their security policy offered by each bank to their clients, which would include policies regarding what happens in case of a robbery, loss of money or fraudulent use of your credit card or bank account.

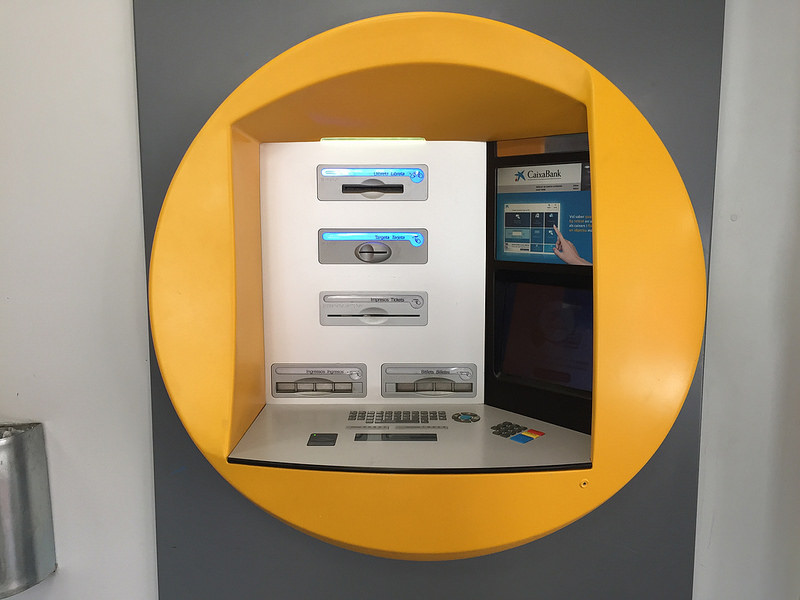

It doesn’t do any good if a bank offers amazing deals or discounts but then won’t cover these situations when they occur. Another factor to keep in mind are the commissions covered by the bank and the interest rates it operates with. This is where online banks tend to win out over physical banks; they offer lower commissions or sometimes have none at all in order to attract and build more loyalty with customers. Although nowadays most people use their card to pay for everything, some people are still more accustomed to carrying around cash to pay for everyday purchases. If you fall into the latter category, it’s important to see if your bank offers convenient ATMs around the city. It’s also a good idea to compare the fees your bank charges to withdraw money at the ATM of another bank.

Related article: Moving To Madrid

Comfort is another aspect that you want to look for in any service you use regularly, and your bank should be no exception. Although many people may opt for a traditional bank, it’s important that the bank also offers a simple, easy-to-navigate online platform that allows for common operations such as transfers and check deposits via a mobile app. If you are putting a hefty amount of money into a bank account, it may be a good idea to open up different bank accounts and distribute some of the money between them. It’s important to make sure that the bank has a deposit guarantee of 100,000 euros maximum to protect against bankruptcy. If you have more than this quantity and the bank ends up closing, you will recover no more than the maximum 100,000 euros. Overall, it’s wise to ensure that all the conditions offered by the bank will ultimately protect your money and provide you peace of mind.